Liquidations

Liquidation is a critical mechanism within Mars V2 designed to protect the protocol from losses due to undercollateralized loans. When a borrower's collateral value falls below a certain threshold, their position becomes undercollateralized, posing a risk to lenders. Liquidation serves to mitigate this risk by automatically selling the borrower's collateral to repay the outstanding loan. A thorough understanding of the liquidation process is essential for both lenders and borrowers within the Mars V2 ecosystem. For lenders, it ensures the safety of their deposited funds. For borrowers, it provides knowledge on how to avoid liquidation and manage their positions effectively. By comprehending the liquidation mechanics, participants can make informed decisions and optimize their interactions with the protocol.

What is Liquidation on Mars

Liquidation is the process of closing an undercollateralized loan by selling the borrower's collateral. This action is triggered when the value of the collateral falls below a predetermined liquidation threshold (i.e., 1), which is calculated based on the loan-to-value (LTV) ratio and the close factor.

How Liquidation Protects the Protocol

Liquidation safeguards the protocol by preventing losses for lenders. When a borrower's position becomes undercollateralized, there's a risk that the borrower might default on their loan. By liquidating the position, the protocol recovers a portion of the borrowed funds, reducing potential losses for lenders.

Role of Liquidation in Maintaining System Health

Liquidation plays a crucial role in maintaining the overall health of the Mars V2 ecosystem. By incentivizing liquidation, the protocol ensures that undercollateralized positions are promptly addressed, preventing a cascade of defaults and protecting the stability of the platform.

Liquidation Parameters

There are two major Liquidation Parameters on Mars

-

- Liquidation Bonus

-

- Close Factor (CF)

Liquidation Bonus

The liquidation bonus is a reward offered to liquidators who initiate the liquidation of an undercollateralized position. This incentive encourages users to actively participate in maintaining the protocol's health by liquidating risky positions. The bonus is typically a percentage of the seized collateral, distributed to the liquidator. The potential for profit motivates liquidators to monitor the protocol for undercollateralized positions, thereby helping to prevent losses for lenders.

Close Factor

The close factor is a multiplier applied to the loan-to-value (LTV) ratio to determine the liquidation threshold. It is a safety buffer that ensures sufficient collateral remains after liquidation to protect lenders. Within this new system, the CF will be determined dynamically using a parameter known as the Target Health Factor (THF). The THF is a governance-defined (and updatable) parameter that determines the ideal HF a position should be left at immediately after the position has been liquidated. The CF, in turn, is a result of this parameter: the maximum amount of debt that can be repaid to take the position to the THF. For example, if the THF is 1.10 and a position gets liquidated at HF = 0.98, then the maximum amount of debt a liquidator can repay (in other words, the CF) will be an amount such that the HF after the liquidation is at maximum 1.10.

Key Terms

Before moving ahead, it is important we understand the other key terms:

-

1. Max LTV (Loan-to-Value Ratio): The maximum amount that can be borrowed relative to the value of the collateral. For example, if you deposit 1WBTC worth $60,000 as collateral and it’s Max LTV is 80%, you can only borrow up to $48,000.

-

2. Liquidation LTV: It is the threshold at which a position is considered undercollateralized and subject to liquidation. It's typically set below the Max LTV to provide a safety margin. However, on Mars, it is greater than Max LTV. If the value of your collateral falls below the Liquidation LTV, the platform may automatically sell your collateral to repay the loan.

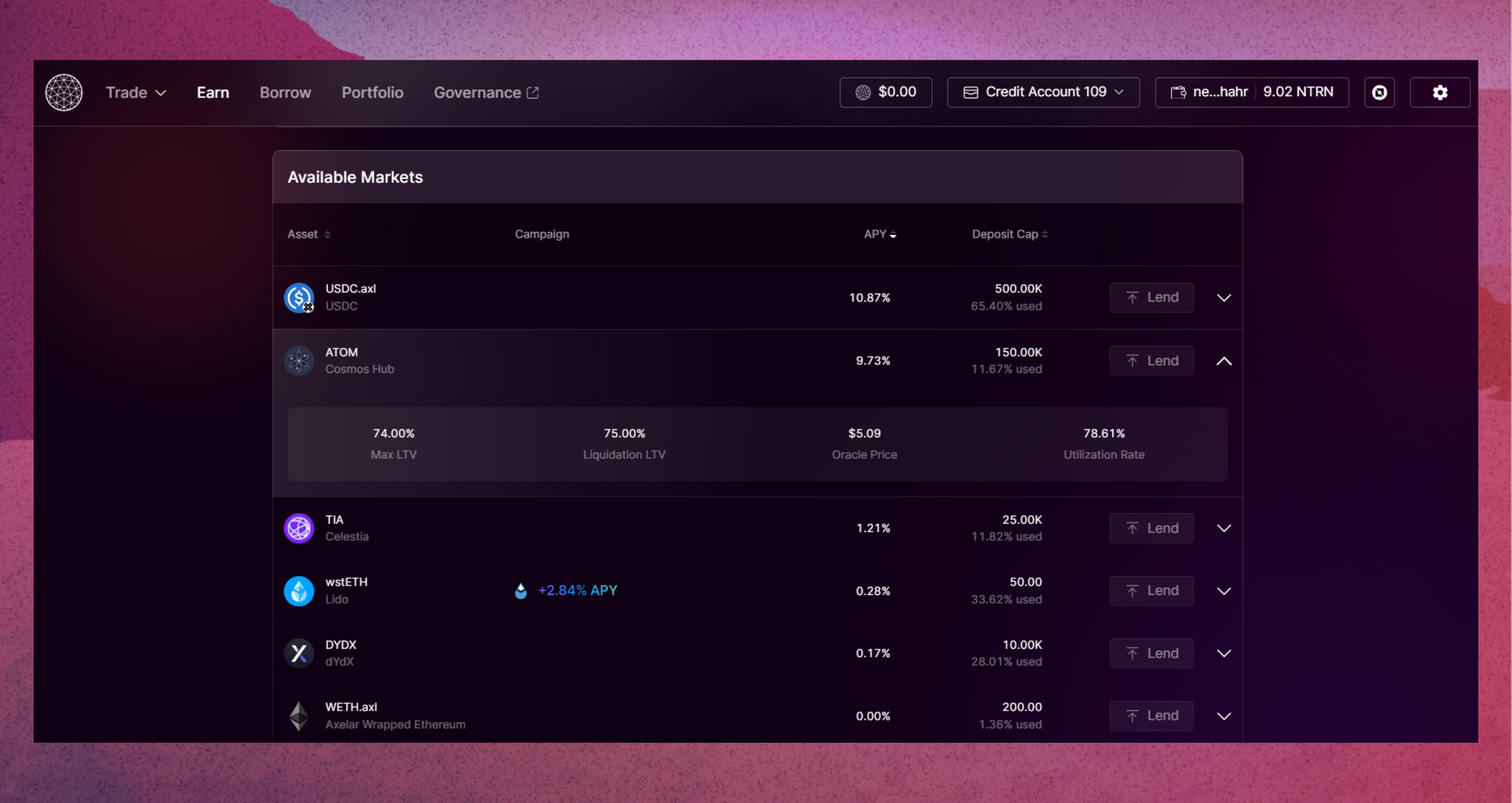

You can check the example below. In this scenario, the Max LTV is 74% and Liquidation LTV is 75%.

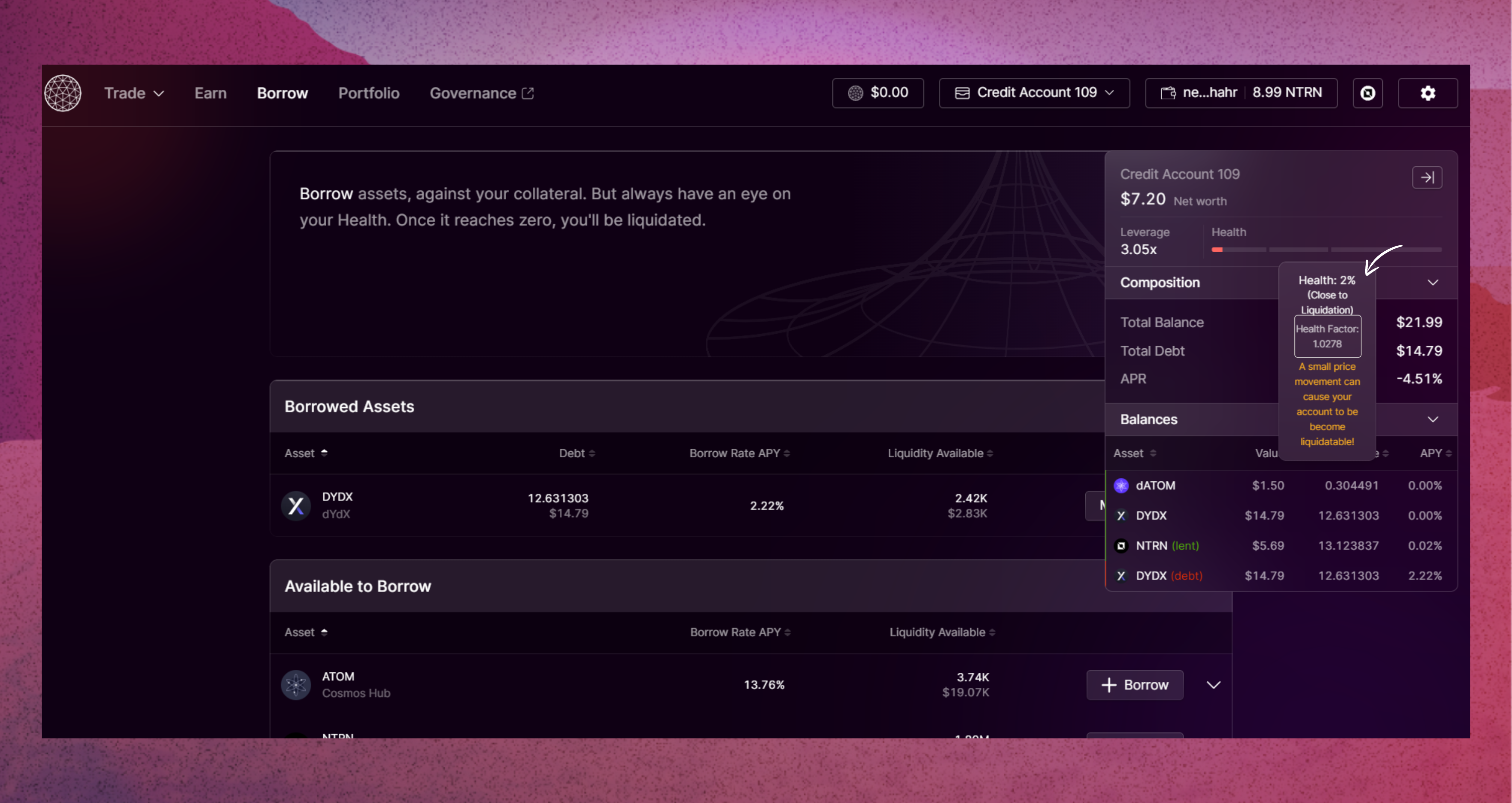

- 3. Health Factor: A ratio of collateral value as per Liq LTV to debt, indicating the health of a loan position. For example in the below scenario, the health of the user is 50% with a health factor of 1.87. However, if the user borrows more and due to price fluctuations the value of collateral falls down or the value of debt increases, the Health factor may fall below one, which may lead to liquidation.

Liquidation Process

The liquidation process on Mars V2 can be broken down into the following steps:

-

- A third-party liquidator uses on-chain data to identify an account that has a health factor of less than 1 as per LiqLTV

-

- This liquidator identifies a debt asset they wish to pay back on behalf of an account.

-

- This liquidator also identifies the collateral asset they wish to receive.

-

- The liquidator pays back an arbitrary amount of the user’s debt, up to the close factor (i.e. if the close factor is 50%, the liquidator can only repay up to 50% of the user’s debt in a single liquidation transaction).

-

- The liquidator receives a portion of the user’s collateral equal to the debt repaid and a liquidation bonus (i.e. if the liquidation bonus of the given collateral asset is 10% and the liquidator repaid an equivalent of $100 USD of the user’s debt, the liquidator would receive $110 USD worth of the user’s collateral)

To illustrate the process, let’s take an example:

Alice has deposited 5 BTC = $100,000 in the Mars credit account as collateral and has borrowed 40 ETH at $10,000. Assuming the LiqLTV at 82% of the value the collateral power of BTC will be $420,000 [(5*100,000)*82%].

In this scenario, the health factor is 1.05 (420,000/400,000).

If the price of ETH increases to $11,000, the value of the borrowing/debt will also rise to $440,000. Now, the net worth will be equal to $60,000 ($500,000 - $ $440,000) This price fluctuation may lead to a fall in health factors from 1.05 to 0.93.

Now because the health factor is <1 the position can be liquidated.

Now, the liquidator can decide to provide 30 ETH back to the protocol and get a Liquidation Bonus.

Let’s say the Liquidation Bonus is 10%, then here’s how it will work:

-

- The liquidator will liquidate BTC equivalent to 30 ETH from the collateral (considering the closing factor)

-

- BTC amount =

3.3 ($11,000*30)/100,000

- BTC amount =

-

- He will also get

0.33 BTCas a Liquidation Bonus($100,000*0.3 = $30,000)

- He will also get

-

- Provide those

30 ETHback to the protocol and reduce the total debt of the user.

- Provide those

Now the new equation will be:

Collateral = (5 BTC - 3.6 BTC) @100,000 = 1.4 BTC @100,000 = $140,000

Adjusted Liquid LTV @82% = $140,000*82% = 114,800

Borrowing = (40 ETH - 30 ETH) @11,0000 = 10 ETH @11,000 = $110,000

New Health Factor: 140,000/110,000 = 1.04.

Net worth after liquidation: $140,000 - $110,000 = $30,000

That means the user had to incur a penalty of $30,000 ($60,000 - $30,00) i.e., (net worth before liquidation - net worth after liquidation).

Governance's Role In Setting Parameters

The protocol's governance body plays a crucial role in determining liquidation parameters such as liquidation bonuses, close factors, and health factor thresholds. These parameters are subject to change based on market conditions and risk assessments.

Key functions of the governance body in setting liquidation parameters:

Risk Assessment: The governance body of Mars protocol analyzes market conditions, asset volatility, and potential risks to determine appropriate liquidation thresholds.

Parameter Adjustment: Based on these assessments, Mars can propose and implement changes to liquidation bonuses, close factors, and health factor thresholds.

Community Input: Mars often seeks community involvement in decision-making processes through proposals and voting mechanisms. This ensures that the parameters reflect the needs and preferences of the user base.

Transparency and Accountability: Mars's governance body is responsible for transparently communicating changes to liquidation parameters and providing justifications for its decisions.

Precautions for users to protect themselves from Liquidation

Borrowers can implement several strategies to minimize the risk of liquidation:

- Maintain Adequate Collateralization: Ensuring that the value of the collateral consistently exceeds the loan amount by a substantial margin helps prevent liquidation.

- Monitor Health Factor: Regularly checking the health factor of a loan position allows borrowers to identify potential risks early on and take corrective actions.

- Manage Debt Levels: Prudent borrowing and timely debt repayment can significantly reduce the likelihood of liquidation.

- Diversify Collateral: Spreading collateral across different assets can help mitigate the impact of price fluctuations on a single asset.

The health factor is a crucial indicator of a loan's health. It represents the ratio of the collateral value to the loan amount. By closely monitoring the health factor, borrowers can proactively manage their positions and take steps to avoid liquidation.